In early 2016, financial markets faced a significant blind spot. The upcoming Brexit referendum in the UK was looming, and institutions were deeply uncertain about the potential economic fallout. Traditional hedging instruments - equities, gold, and currency options provided only broad protection. Investors lacked a clear way to directly hedge against a "Leave" vote.

Enter the world of political prediction markets.

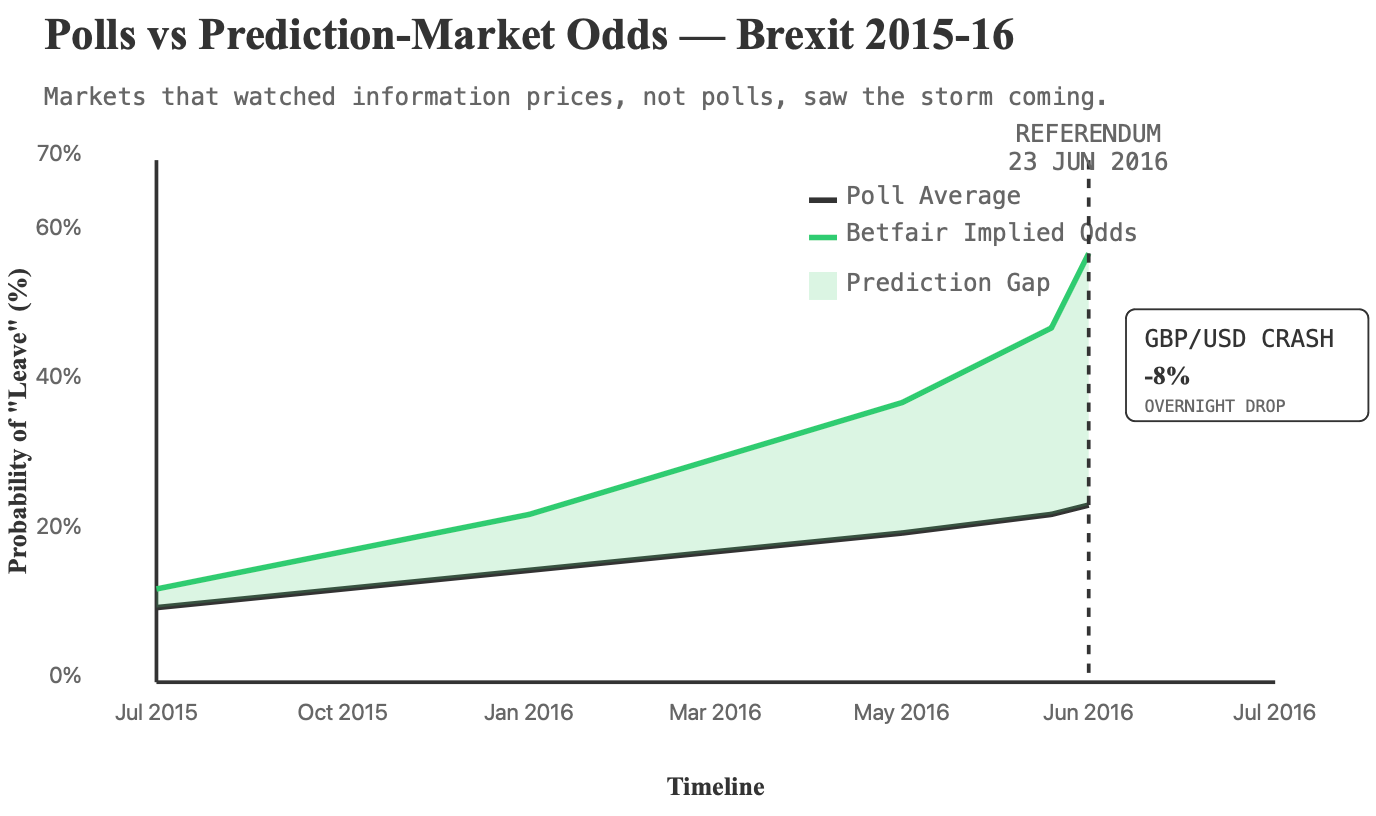

While traditional pollsters forecasted a comfortable "Remain" victory, direct betting markets painted a dramatically different picture. Platforms such as Betfair and PredictIt showed that the probability of Brexit was substantially higher than conventional wisdom suggested.

On the eve of the referendum, prediction markets implied nearly a 40% probability of a "Leave" outcome - significantly higher than polls indicated.

When the "Leave" vote ultimately prevailed, markets were blindsided. Sterling plunged overnight, and global markets lost billions in value.

Those who had paid attention to prediction markets, however, were far better positioned to navigate the chaos.

Some hedge funds had directly hedged exposure based on these probabilities, profiting or significantly mitigating losses from the resulting volatility.

This example reveals a simple yet powerful truth: Traditional finance is often blind to specific event-driven risks. Institutions relying only on conventional hedging instruments missed the signal. But investors who had direct exposure through information markets saw it coming clearly - and acted accordingly.

Financial institutions today still face the same dilemma. Traditional tools like gold, volatility indices, or equity baskets fail to capture the direct, granular risks of events such as elections, technological breakthroughs, or geopolitical shifts. This leaves massive pools of capital waiting on the sidelines, searching for a better way to directly hedge specific events.

Information markets fill exactly this gap. Yet, to attract substantial institutional capital, these markets require greater scale, liquidity, regulatory clarity, and structural standardization. Until then, the full promise of direct event-risk hedging remains largely untapped.

Let’s dive into some case studies

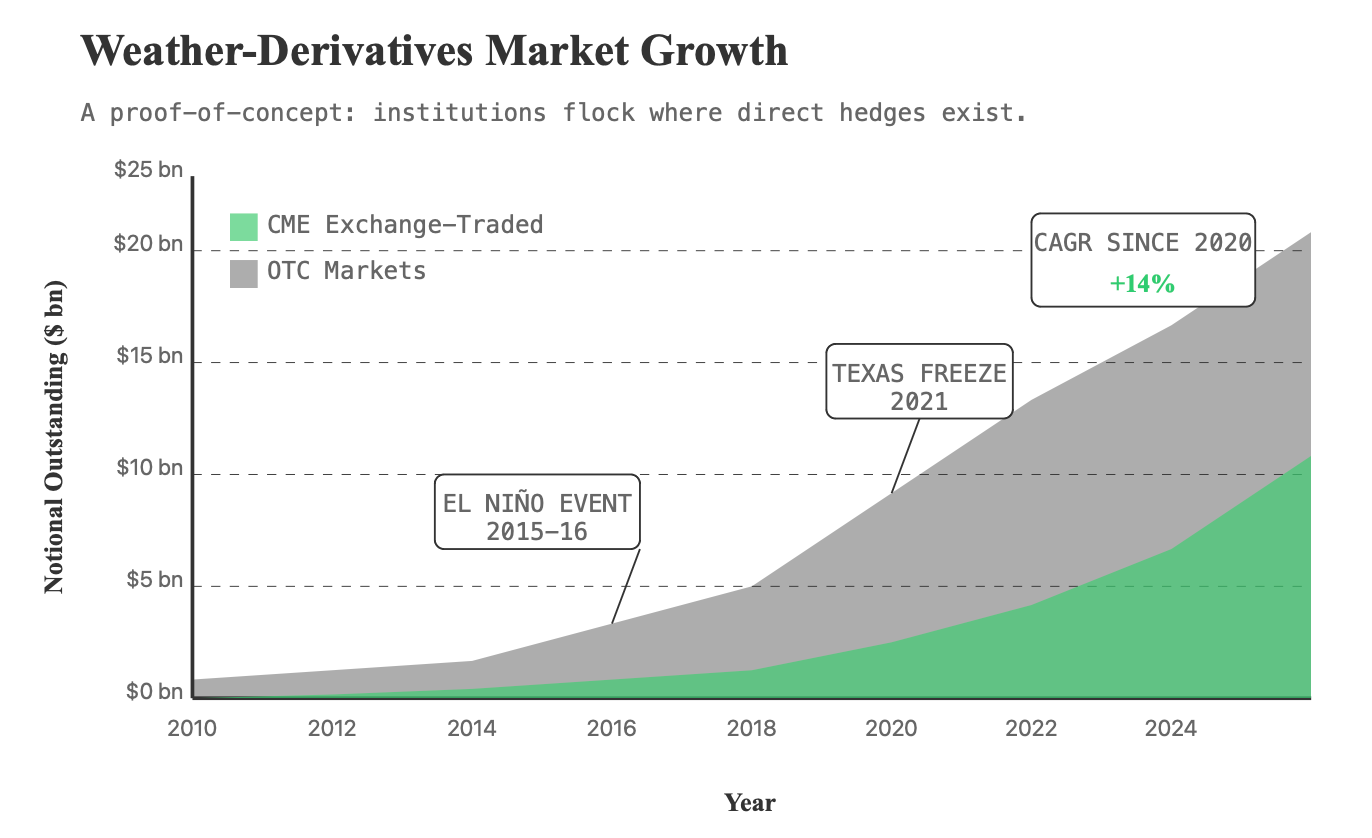

Weather derivatives offer one of the clearest examples of institutions gravitating toward direct event-risk trading.

As of last year, the weather derivatives market had ballooned to approximately $25 billion. Airlines, energy firms, and agricultural businesses rely heavily on these instruments, aiming to hedge directly against specific weather-related events.

Yet despite their popularity, these derivatives mostly trade over-the-counter, fragmenting liquidity and limiting market growth.

Making these derivatives transparent, standardized, and widely tradable could unlock far greater institutional allocations.

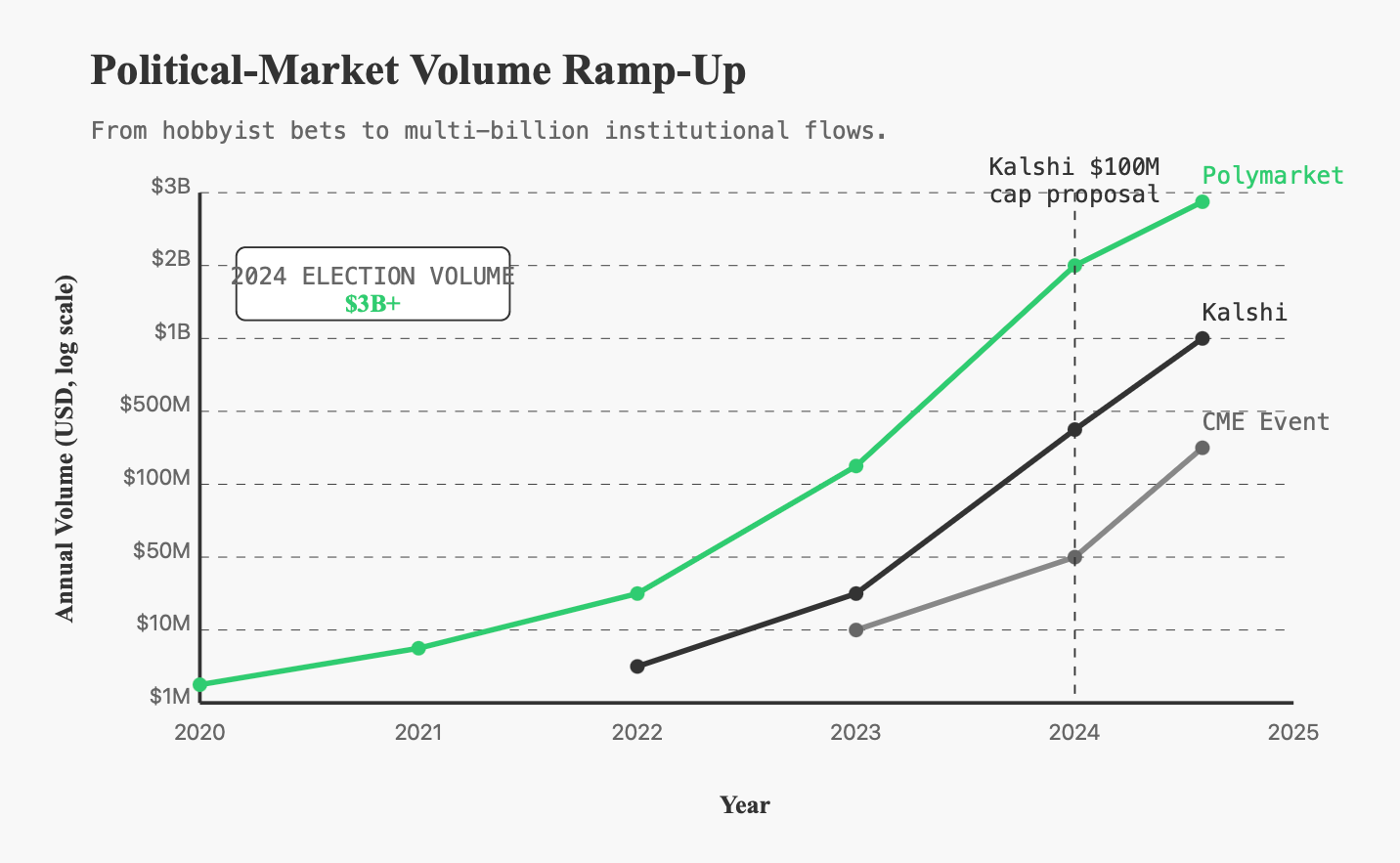

Political prediction markets are moving rapidly from curiosity to mainstream strategy. In the run-up to the 2024 U.S. presidential elections, platforms like Polymarket clocked more than $3 billion in trading volume - c learly indicating a sophisticated and deep-pocketed participant base.

Regulated players such as Kalshi are pushing this further, lobbying regulators to raise market caps up to $100 million.

CME’s event contracts related to elections and macroeconomic announcements routinely see more than 100,000 trades per day at peak times.

Yet, current position limits and fragmented liquidity remain major bottlenecks.

Hedge funds consistently look for better ways to directly hedge against major economic data releases: like inflation reports or Fed announcements. For instance, Kalshi’s CPI contracts have seen impressive activity, attracting millions in volume. However, with a cap around $7 million per position, these markets remain constrained. Polymarket, too, saw single-market Fed-related volumes surpass $6 million recently. Yet again, strict position limits keep significant institutional capital waiting on the sidelines.

Until these structural roadblocks disappear, hedge funds remain stuck using indirect products like VIX futures or bond derivatives - imperfect hedges at best, expensive hedges at worst.

Consider just six major hedge funds for context:

Collectively managing $363 billion, these institutions represent only a fraction of the market. If just 0.25% of their combined AUM found its way into structured event markets, nearly $900 million in fresh capital would immediately enter the space. Doubling that conservative allocation to half a percent easily puts the figure around $1.8 billion.

This calculation ignores corporate treasuries, commodities traders, and even sovereign wealth funds, who regularly handle billions and need efficient hedging mechanisms for geopolitical and economic event risks.

Several structural issues currently block institutional capital from flowing freely:

Addressing these issues is essential before institutions jump in at scale.

Institutions want markets that give them exactly what they're after:

Institutional adoption of information markets isn’t speculative: it’s already begun. Weather and political markets have provided proof of concept. But to reach their full potential, these markets need improvements in liquidity structure, collateral efficiency, and regulatory position limits. When these changes arrive, billions currently parked in proxy hedging instruments will finally find their ideal destination.

Structured event markets are poised to become a natural home for institutional risk management, fundamentally reshaping how financial institutions hedge against uncertainty.

PJ is builing factcheckdotfun, which fights disinformation with truth-seeking markets, and is backed by AllianceDAO.